where's my unemployment tax refund irs

An immediate way to see if the IRS processed your refund is by viewing your tax records online. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

People who received unemployment benefits last year and filed tax.

. 22 2022 Published 742 am. Your unemployment refund is based on the amount on the 1040 Schedule 1 line 7 unemployment compensation. Your Adjusted Gross Income AGI not including unemployment is less than 150000.

The tool tracks your refunds progress through 3 stages. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. The tool provides the refund date as soon as the IRS processes your tax return and.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. Check your unemployment refund status by entering the following information to verify your identity. For folks still waiting on the Internal Revenue Service.

Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. Your tax on Form 1040 line 16 is not zero.

You did not get the unemployment exclusion on the 2020 tax return that you filed. Viewing your tax records online is a quick way to determine if the IRS processed your refund. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144 billion for tax year 2020. By Anuradha Garg. Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes.

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. The IRS will send out the extra refunds via direct deposit starting on Wednesday July 14 using the bank account it has on file from your 2020 taxes. Another way is to check your tax transcript if you have an online account with the IRS.

This post is for discussion purposes only and is NOT tax advice. Ad Learn How Long It Could Take Your 2021 Tax Refund. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

If you claim unemployment and qualify for the adjustment you don. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Until then any and all submitted tax returns for the current season are blocked from being put into the system so the IRS can finish any maintenance repairs updates and testing.

The IRS has sent 87 million unemployment compensation refunds so far. Unemployment benefits are generally treated as taxable income according to the IRS. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

People might get a refund if they filed their returns with the IRS before. Wheres My Refund. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Still they may not provide information on the status of your unemployment tax refund. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income.

But the 1040 line 11 AGI must be less then 150000 to qualify. - One of IRSs most popular online features-gives you information about your federal income tax refund. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment.

See How Long It Could Take Your 2021 Tax Refund. The average refund this time around is 1265 according to a Tuesday news release. This is because there is nowhere for your return to specifically go until the IRS begins accepting and processing returns for the tax season.

You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. You get personalized refund information based on the processing of your tax return.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. BTW the 1040 form line 16 is the tax on the line 15 income. If youre married and filing jointly you can exclude up to 20400.

If you didnt opt for direct deposit you can expect to receive a paper check. 1 the IRS announced it had sent about 430000 tax refunds to taxpayers who overpaid taxes on their unemployment in 2020.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Where S My Tax Refund How To Check Your Refund Status Tax Refund Filing Taxes Tax

Where Is My Money Smokey Where Is My Money Tax Refund Unemployment

This Chart Depicts The Presidents Proposal For Budgetary Spending For The Coming Year This Is Significant Because It Illustrates The Importance Of Pinteres

How To Receive Your Unemployment Tax Refund As Com

Irs Tax Refund Delays Persist For Months For Some Americans Abc11 Raleigh Durham

Kingston Smith Llp Accountants Fraud Criminal Evidential Files Carroll Trust Auditors Case Trust Tax Trust Fund

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Tax Refund How To Check Your Refund Status Tax Refund Filing Taxes Tax

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

1040 2020 Internal Revenue Service In 2021 Internal Revenue Service Tax Forms Helpful Hints

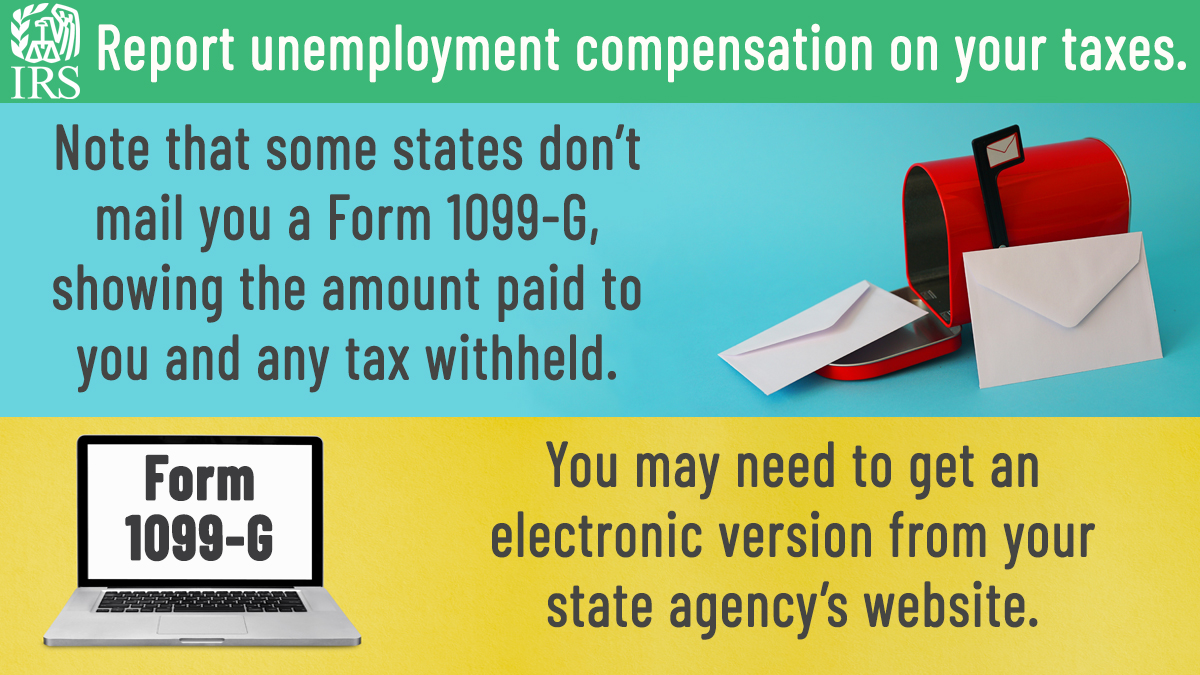

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

Redi Ceo Says High Property Taxes Likely Deterring Growth In Pocatello Local Idahostatejournal Com Property Tax Pocatello Economic Development